Centralized Decision Logic. Organized and Accessible

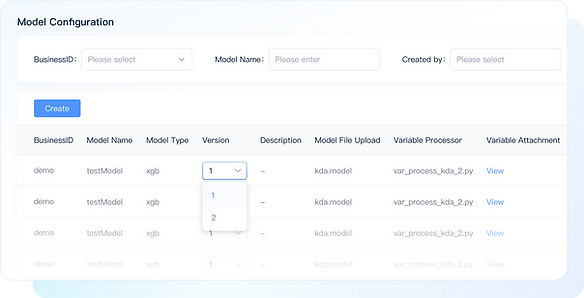

Easy Deployment: Seamlessly deploy custom or third-party models without complex coding.

Multi-Model Support: Run multiple predictive models simultaneously for more accurate decisions across customer segments.

Version Control: Quickly update or roll back models with built-in version management.

Transform Business Rule Management and Decision-Making

Rule Variables

Define and use rule variables to quickly adapt decision logic to changing conditions

Minimize Risk

Reduce default rates with advanced risk analytics and dynamic data orchestration

Enhance Your Team

Get expert support from our professional services team whenever you need it

Smarter Decisions

Gain a holistic view of creditworthiness with alternative data and seamless workflow integration

Refine Your Strategy

Optimize decisions with built-in intelligence and actionable insights

Design. Integrate. Deploy.

Drag-and-Drop Decision Flow Designer:

Enables users to visually create and adjust credit decision workflows, minimizing reliance on technical teams

Shadow Testing:

Supports running strategies in production environments without impacting live decisions, collecting insights for further refinement.

Real-Time Risk Evaluation:

Continuously calculates risk scores during critical decision points to ensure up-to-date assessments.

Rule Versioning and History Tracking:

Maintains a complete version history of all rules, ensuring traceability and easy rollback to previous configurations if needed.

A/B Testing:

Enables parallel testing of multiple strategies or rules to identify the most effective approach.

Multi-Source Scoring:

Combines data from multiple sources to create comprehensive and contextual risk profiles.